By next year, a worldwide research organization suggested that Amazon add Bitcoin to its strategic reserve. Michael Taylor’s Microsoft proposal from a few weeks ago is identical to this one.

Amazon, the fifth-largest firm in the world, has been presented with the Bitcoin BTC-0.73% Bitcoin strategic reserve by the National Center for Public Policy Research, an independent global conservative think tank with headquarters in Washington, D.C.

The goal of this proposal is to ask the company’s $88 billion in cash and cash equivalents—which includes corporate, international, and U.S. government bonds—to think about including Bitcoin in its strategic reserve by the time of the next annual meeting in April 2025.

“Even though those assets are more volatile in the short term, Amazon should—and possibly has a fiduciary duty to—consider adding assets to its treasury that appreciate more than bonds.”

According to the document that Tim Kotzman presented X’s post on Dec. 09

The primary justification for the company’s adoption of Bitcoin, like the other companies did, is the U.S. inflation rate, which peaked at 9.1% in June 2022. Holding these assets is insufficient to safeguard billions of dollars for shareholders, as their bond rates also did not surpass actual inflation.

Additionally, according to the National Center, Bitcoin has outperformed bonds by 126% over the last 12 months, rising to 131%. In a single year, it also beats corporate bonds by 1.246%.

Also read: This week, Microsoft shareholders will decide whether to invest in Bitcoin.

Amazon using MicroStrategy as an example

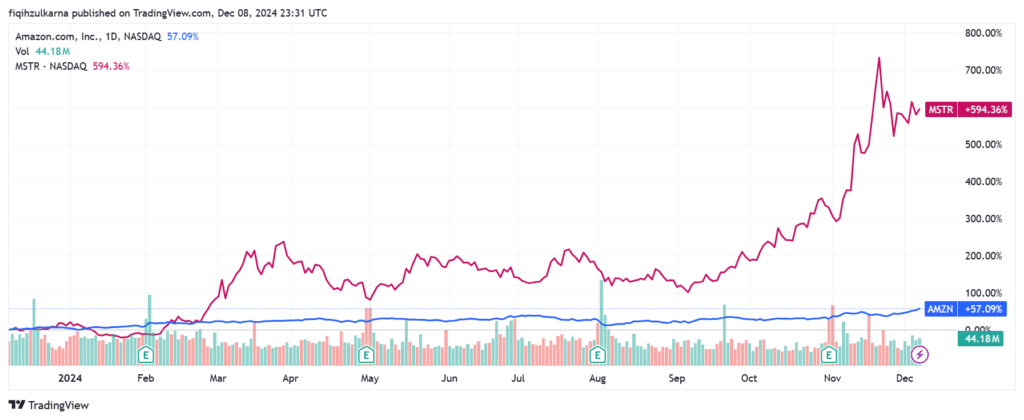

The move was initiated by MicroStrategy in 2020 when they added Bitcoin as a financial instrument. Since then, the stock performance has soared by 594%, surpassing the 57% annual growth in Amazon (AMZN) stock.

Michael Saylor, the executive chairman of MicroStrategy, also provided Microsoft with the Bitcoin reserve a few weeks ago; the corporation will make a decision this week.

They added that numerous organizations and businesses, including BlackRock and Fidelity, which earlier this year released Bitcoin’s ETF to the stock market, are following Saylor’s lead.

In conclusion, the National Center has recommended that Amazon invest at least 5% of its assets in Bitcoin to diversify its balance sheet. In addition to being a necessary step for tech companies, this action should protect their assets and shareholders’ value given the unparalleled inflation of digital assets.